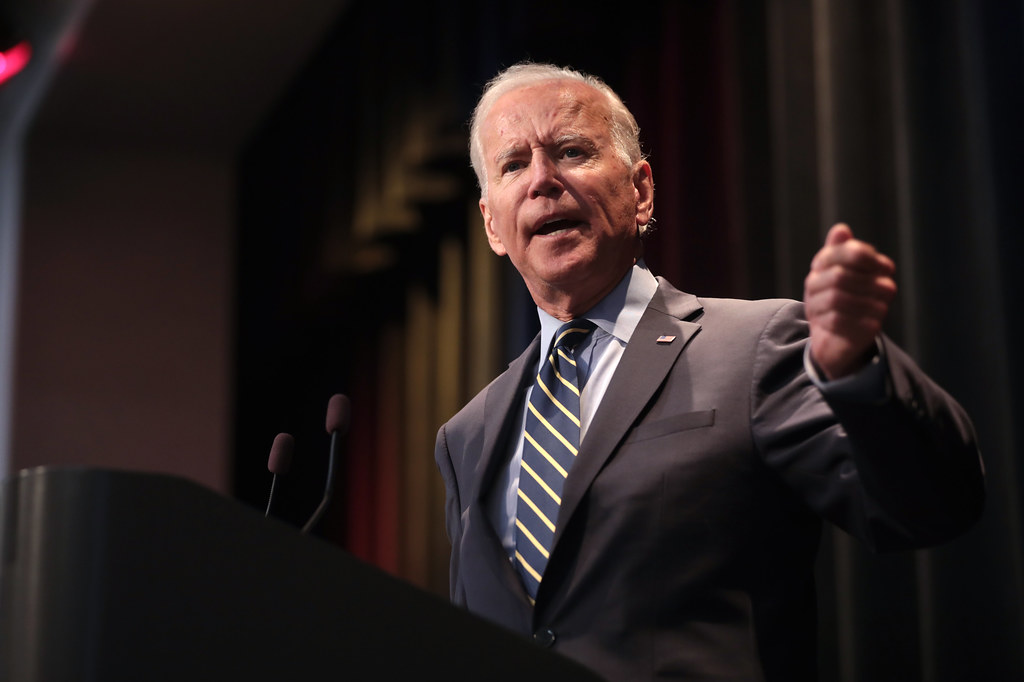

In an ambitious move to overhaul the U.S. tax system, President Joe Biden is setting the stage for significant tax reforms aimed at ensuring that billionaires and corporate America contribute their fair share to the nation’s economy. The President’s plan is a shout against the longstanding inequities in the tax code, promising to usher in a new era where work is rewarded over wealth, and the financial burden is evenly distributed.

At the heart of Biden’s proposal is the commitment to make the tax system fairer while staunchly opposing Republican efforts to perpetuate tax cuts for the affluent and major corporations. The President’s strategy is multifaceted, focusing on delivering tax cuts for families with children and working Americans, propelling investments within the country, and slashing deficits by trillions of dollars through a new billionaire minimum tax and an aggressive stance against multinational companies that dodge domestic contributions by shifting jobs and profits overseas.

Since his tenure began, President Biden has championed the creation of a more equitable tax landscape. Historic legislation under his administration has already seen the implementation of a 15% corporate minimum tax, ensuring that billion-dollar entities cannot evade federal income taxes. Moreover, the Internal Revenue Service (IRS) has been equipped with enhanced tools to clamp down on affluent tax evaders.

The proposed changes are vast and impactful. Biden seeks to raise the corporate tax rate to 28% and set the corporate minimum tax at 21%, reversing what he views as the massive tax giveaways to big corporations made by the Republicans in 2017. Additionally, the President is tackling tax avoidance by large multinationals and the pharmaceutical industry by pushing for a minimum tax rate agreement on an international scale. Other significant measures include denying corporations tax deductions for exorbitant executive compensations, quadrupling the stock buyback tax, and eliminating favorable tax treatments for corporate and private jets.

On the individual front, Biden is adamant that the wealthiest 0.01 percent, those with a net worth exceeding $100 million, should not escape their fiscal responsibilities. His plan introduces a 25 percent minimum tax for billionaires, addressing the loopholes that have historically allowed them to pay significantly less than the average American worker. Furthermore, the President aims to secure Medicare’s future by increasing the Medicare tax rate on income above $400,000 and directing all Medicare tax revenue into the Medicare Hospital Insurance Trust Fund.

The broader vision encompasses significant tax cuts for working families and the middle class, with measures including the restoration and expansion of the Child Tax Credit and the strengthening of the Earned Income Tax Credit. These changes promise to alleviate the financial strain on millions of Americans, cutting child poverty drastically and offering substantial savings on health insurance premiums.

President Biden’s tax reform plan is a bold stride toward rectifying the imbalances in the U.S. tax system, ensuring that the wealthy and corporate giants contribute their fair share. It stands as a testament to the President’s unwavering commitment to build a more equitable and prosperous future for all Americans, defying the status quo and laying down the gauntlet for a fairer taxation system.

Related posts:

FACT SHEET: President Biden Is Fighting to Reduce the Deficit, Cut Taxes for Working Families, and Invest in America by Making Big Corporations and the Wealthy Pay Their Fair Share

President Biden to push corporate, billionaire tax hikes at State of the Union, drawing contrast with Trump

Joe Biden to propose massive tax raid on super rich and corporate America in tonight’s State of the Union address with sweeping hikes including minimum corporate tax up from 15% to 21% and a 25% rate