The financial landscape for Trump Media & Technology Group took a dramatic turn as the company’s shares plummeted following a significant reported loss. On Monday, the share price closed 21.47% lower, a stark contrast to the company’s recent public trading commencement. This downturn came on the heels of a net loss disclosure of $58.2 million against a modest revenue of $4.1 million for the year 2023.

Trump Media, associated with former President Donald Trump, saw its shares take a nosedive by over 25% around 1:08 p.m. ET, later regaining some ground as the day progressed. The closing price stood at $48.66 per share, a sharp fall from the previous week’s high of $79.38 per share. Despite this, the market capitalization hovered around $6.6 billion.

The financial reverberations impacted Trump’s personal holdings in the company, with his shares in Trump Media dropping to an estimated value of $3.8 billion, a $2.5 billion decrease from the prior week. The company’s financial health came into the spotlight with its first 8-K filing with the Securities and Exchange Commission since going public through a merger with a shell company. The filing outlined the loss for the past year, with a significant portion attributed to $39.4 million in interest expense.

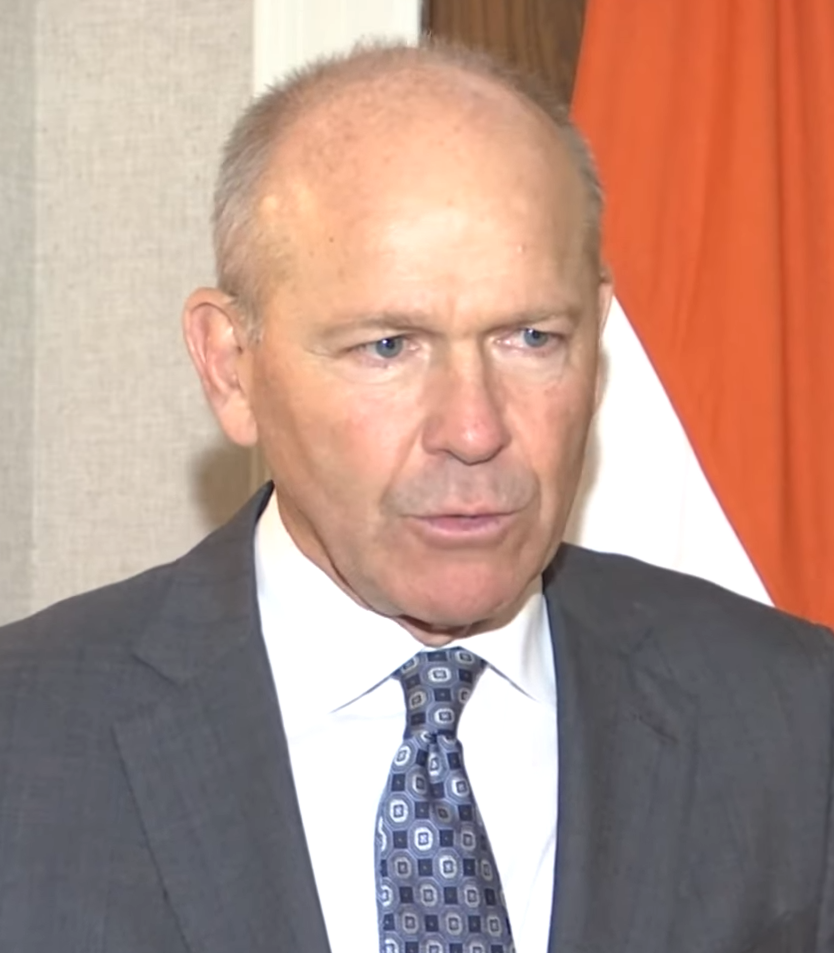

In response to inquiries about the financial results, a spokesperson for Trump Media directed attention to a news release issued Monday evening. CEO Devin Nunes expressed optimism, stating, “We are excited to be operating as a public company and to have secured access to capital markets.” He highlighted the company’s debt-free status and substantial cash reserves, expressing intentions to expand and enhance the Truth Social platform and establish it as a leading free-speech platform.

The previous year’s financials painted a different picture, with Trump Media reporting a net profit of $50.5 million, primarily due to a $75.8 million gain from a “change in fair value of derivative liabilities.” However, the company anticipates continued operating losses for the foreseeable future, as noted in the SEC filing. The filing also cautioned shareholders about the unique risks associated with Trump’s involvement in the company and disclosed “material weaknesses in its internal control over financial reporting” from earlier financial statements for 2023.

The company’s financial challenges are underscored by the broader context of Trump’s financial situation. With legal and financial hurdles mounting, including a civil fraud penalty and the need to secure funds to cover various legal obligations, Trump Media’s performance is critical. The company’s public market entry could potentially bolster Trump’s finances, although no immediate payout has occurred, and insider share sale restrictions remain in place. As Trump Media navigates its financial future, the company’s ability to attract users, platform partners, and advertisers will be pivotal. With the 2024 presidential election on the horizon, the company’s strategy and performance will be closely watched by investors and industry observers alike.

Related posts:

Trump Media stock closes 21% lower after company reports $58 million loss for 2023

Trump’s DJT stock plunges after posting a big loss for 2023

Trump Media stock falls more than 21% after company discloses $58 million loss for 2023