In a startling turn of events that has caught the attention of the global financial community, two senior executives from Binance, the world’s largest cryptocurrency exchange, find themselves in a precarious situation in Nigeria. Tigran Gambaryan and Nadeem Anjarwalla, key figures in Binance’s operations, are currently detained in the African nation, and the silence surrounding their predicament is as concerning as it is deafening.

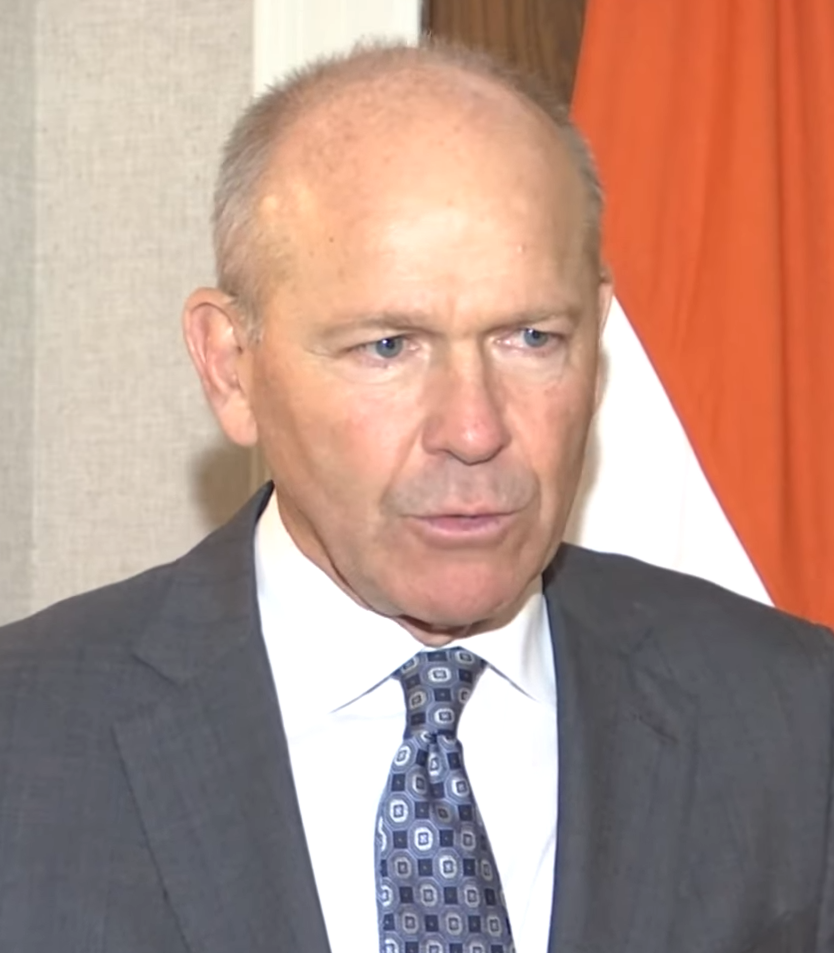

Gambaryan, a U.S. citizen and the head of financial crime compliance at Binance, along with Anjarwalla, a British-Kenyan and the regional manager for Africa, flew to Nigeria as a response to the country’s ban on several cryptocurrency trading websites. Their arrival on February 26 was met not with the usual hospitality but with immediate detention, a move that has since sparked international concern.

The duo appeared before a Federal High Court in Abuja on Tuesday, but neither the Court nor their lawyers have offered comments on the proceedings. The Economic and Financial Crimes Commission (EFCC) of Nigeria is pushing for an extension of their detention, which the Binance executives are contesting. The judge has yet to rule on the EFCC’s request, leaving Gambaryan and Anjarwalla in limbo until the court resumes on April 5th.

The situation is a complex one, with the Nigerian government accusing Binance of contributing to the country’s foreign exchange woes through rate manipulation. Amidst chronic dollar shortages, cryptocurrency websites have become popular trading platforms for the Nigerian currency, leading to a crackdown by authorities. Binance, for its part, has halted all transactions in Nigeria’s naira currency after March 8, a move that has undoubtedly added to the tension.

The arrest of Gambaryan and Anjarwalla is not an isolated incident but part of a broader narrative of Nigeria’s worst economic crisis in years, characterized by inflation and a devaluing naira. The Nigerian government’s accusations against Binance are severe, including claims of exacerbating the currency’s devaluation and processing billions in untraceable funds.

The families of the detained executives have reported that both men are being held in a guarded house in Abuja, with limited communication allowed under supervision. The US and UK embassies have been notified, and Binance has stated it is working with Nigerian authorities to resolve the situation.

This incident raises critical questions about the intersection of cryptocurrency and national financial stability. Binance’s recent history with regulatory issues, including a hefty fine for flouting US anti-money laundering regulations, casts a shadow over the current predicament.

As the world watches, the fate of Gambaryan and Anjarwalla hangs in the balance, emblematic of the volatile relationship between emerging financial technologies and established monetary systems. The outcome of this case could have far-reaching implications for the cryptocurrency industry and the sovereignty of national economies.

The Nigerian government’s collaboration with various agencies to clamp down on illicit financial activities has led to this high-profile detention, signaling a firm stance against perceived threats to the country’s economic health. Meanwhile, the suspension of naira services by Binance has sent ripples of fear through the Nigerian cryptocurrency community, with concerns about the future of digital asset trading in the country. As the April 5th court date approaches, the international community awaits clarity on the charges, if any, that will be brought against the Binance executives. The unfolding drama is a stark reminder of the delicate balance that must be struck between innovation and regulation in the financial world.

Related posts:

Binance Executives Remain in Detention After Nigeria Court Appearance, Families Say

Nigeria seeks to prolong detention of Binance executives

Nigeria detains two Binance execs over currency crisis